Is this the right time to invest in sugar? It has some defensive properties during recessions

Everyone will have a long list of items to buy at the grocery store as Easter draws near. However, should one or two sugar investments be included as well?

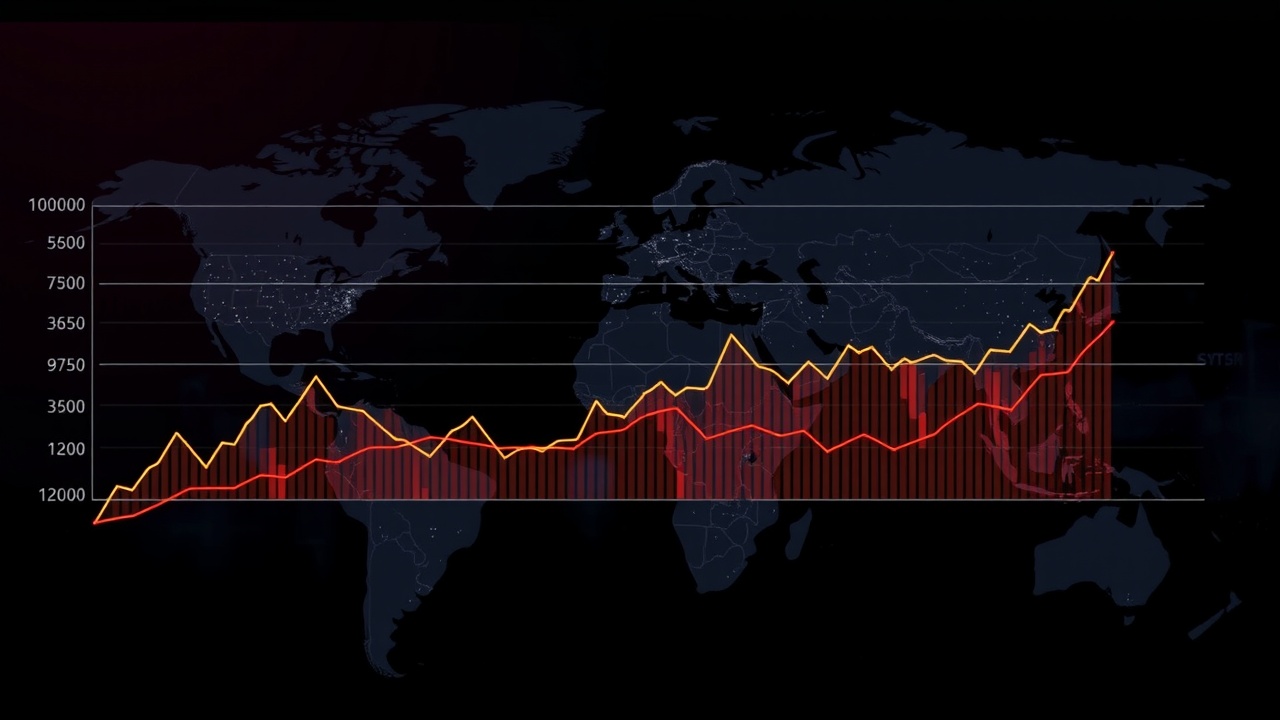

You could diversify your portfolio and keep it away from stock market ups and downs by adding a sweetener. Historically, the bond and equity markets have not been very correlated with sugar in particular. This is due to the fact that the primary factors influencing sugar prices are supply-side and mostly influenced by weather patterns in Brazil, India, and Thailand, the world's three largest producers of sugar.

According to Aneeka Gupta, director of macroeconomic research at WisdomTree, "those sharp price spikes that we observe in sugar are typically caused by supply shocks." Sugar tends to be a commodity that offers a significantly lower correlation to these more general assets that an investor would be holding, which is why it provides that diversification benefit when we consider the larger macro narrative that is playing out in the markets.

Despite the defensive nature of sugar, it should be noted that it is a complex commodity, and investing in it at this time is uncertain.

We'll walk you through the sugar investment case, outlining the primary factors influencing sugar prices, how the state of the market may affect them in the future, and how to get exposure to sugar if you start to develop a sweet tooth.

What influences the cost of sugar?

The price of sugar is influenced by three primary factors.

1. . The demand for sugar as a food item is comparatively steady on a global scale. Since sugar is a common ingredient worldwide, demand for it remains high even during recessions. There is even a claim that sugar consumption rises during recessions. During difficult times, households tend to turn to less expensive foods, which are often higher in sugar. For example, during the Great Recession (20082012), British households increased their consumption of sugar by 0.27g per 100g of food, according to research from the Institute for Fiscal Studies. This has historically given sugar defensive qualities, allowing it to protect portfolios during market downturns. The growing need for ethanol to produce biofuels, however, has made this more difficult in recent years.

2. . The best resource for sugar as a biofuel is sugar cane, especially in the nations that produce the majority of the world's sugar. Thus, there is a degree of correlation between sugar prices and global energy prices. If oil prices rise, there is a greater incentive to use biofuel instead, which means that cane farmers are more likely to sell their produce for biofuel rather than to the food industry, which raises the demand for sugar overall. To put it another way, rising energy costs translate into rising sugar costs. Contrary to its historical defensive characteristic, energy demand is becoming more cyclical in its influence on sugar prices due to its strong correlation with the global economy.

3. The third factor influencing sugar prices is supply-side, which is the main focus of the sugar investment case. The climate is the primary determinant of sugar supply, especially in Brazil, India, and Thailand. "Sugar production is often extremely susceptible to weather phenomena such as monsoons, droughts, and the El Nio and La Nia weather cycles," Gupta says. Dryer La Nia weather generally results in lower sugar harvests, which raises prices.

Field of sugar cane.

The primary cause of fluctuations in sugar prices is the impact of the climate on sugar cane crops.

The main argument for sugar investment is largely based on the weather-driven supply dynamic. The primary price influence of sugar is entirely unrelated to the macroeconomic policies that cause the stock and bond markets to rise and fall.

This is a significant source of risk, but it is also the primary justification for sugar's investment appeal, especially during periods of turbulence in the macroeconomic environment.

What effects will tariffs have on the price of sugar?

Tariffs on sugar are generally bad news. The US is the world's biggest consumer and net importer of sugar, despite producing some of it domestically. Therefore, imposing a base 10 percent tariff on all imports may have a negative impact on sugar prices worldwide.

The situation regarding sugar demand appears dire when you consider that a worldwide slowdown may result in lower energy prices due to decreased energy consumption.

But the whole picture is complicated and unpredictable. Sugar's more defensive traits might be activated if the tariffs trigger a worldwide recession.

"Our perspective is that the current policy's uncertainty will lead to a rise in price volatility and a more speculative atmosphere in the sugar market," Gupta says.

It should be emphasized once more that the climate has the largest impact on the price of sugar. Sugar carries some risk, both up and down, but its primary drivers are distinct from those of stocks and bonds.

How sugar investments are made.

There are various strategies you can use if you want to add a little sugar to your portfolio for diversification.

Purchasing stock in sugar companies is one method of investing in sugar. The two biggest in the UK are Tate and Lyle (LON:TATE) and British Sugar, a division of Associated British Foods (LON:ABF). Nevertheless, purchasing commodity stocks like these adds a degree of corporate risk, which helps to clarify the macro picture. As an alternative, an exchange-traded commodity (ETC), which is essentially an ETF that tracks the price of a single commodity, might be a better strategy for getting pure play exposure to sugar prices. Here, WisdomTree Sugar (LON:SUGA) is one choice. Gupta warns that the rolling of those contracts when they reach expiry affects its returns, so its overall returns are dependent on both spot price movements and the roll yield, not just price changes, but this successfully tracks sugar futures. A more comprehensive commodity index, such as the S&P GSCI Softs Index, which monitors the prices of coffee, sugar, cocoa, and cotton, may also include sugar.

Leave a comment on: Can you diversify your portfolio by investing in sugar?