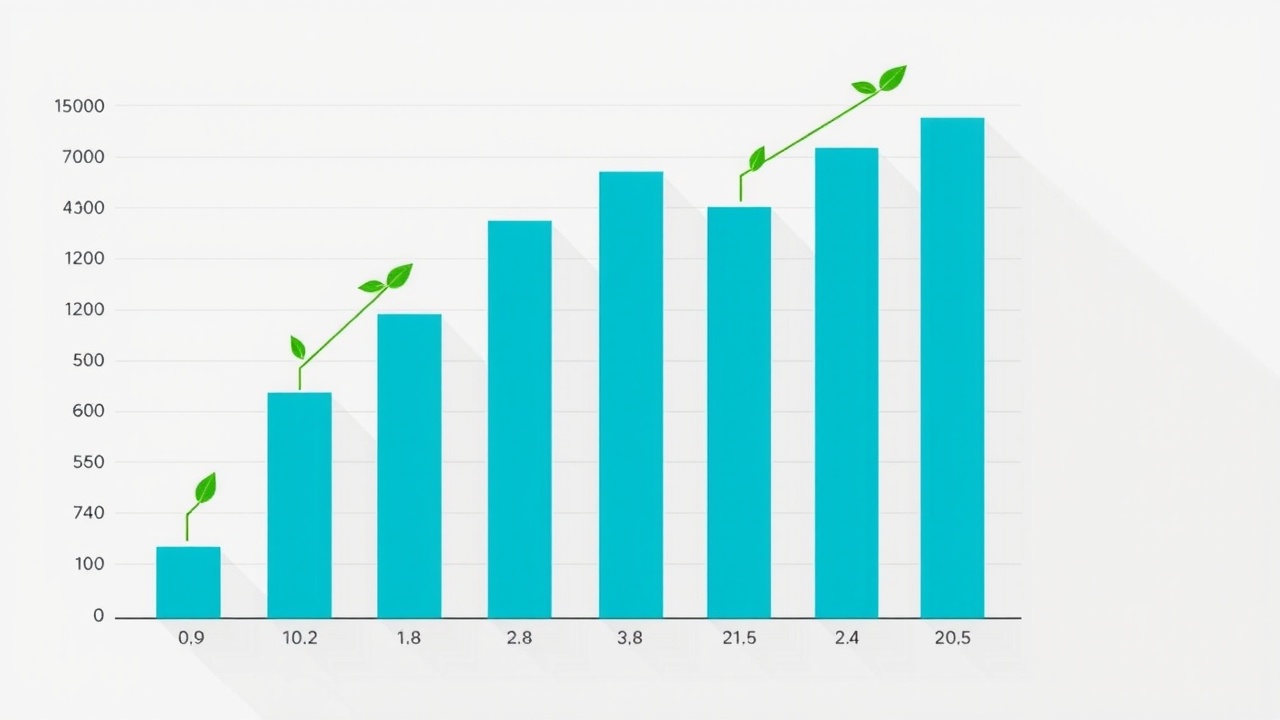

More than half of the UK market's total return over the past 20 years has come from dividends

While investors have been concentrating on US mega cap technology, dividend strategies have received little recognition. In a more challenging investment environment, income strategies might be more attractive.

The manager of Murray Income Trust is Charles Luke.

Investors may have found it choppy, but the markets' reorientation since the year's beginning is a positive development. Investors are beginning to reassess businesses using more logical criteria rather than the drive for growth at all costs. In this setting, dividends' worth as a percentage of long-term returns might be more accurately valued.

Historically, especially in the UK, dividends have played a significant role in the total returns from stock markets. Between 2003 and 2023, an investment in the FTSE 100 would have increased by about 6.3 percent. With a 3 to 5 percent average dividend yield, dividends have accounted for more than half of the total return.

Additionally, dividends fulfill a crucial functional role. Companies may be forced to exercise sound capital discipline by the dividend payment commitment, which may force them to reconsider their investment and spending patterns. Dividends may thus serve as a tool for achieving higher share price returns.

But in the craze for AI-focused capital returns, their significance as a component of total return had been obscured. At the expense of dividend-paying companies' more consistent returns, investors have sought the disproportionate profits in the US technology sector.

For trusts that prioritize dividends, like Murray Income Trust, this trend has proven beneficial. Especially in the unloved UK market, it reduced valuations to extremely appealing levels. Through UK companies, we have been able to access opportunities for global growth at lower valuations. It was time for a reassessment, though, and the change in investor sentiment since the year began is encouraging.

The situation of equity income in the UK.

The equity income asset class in the UK appears to be in as good of shape as it has been in a while. Low valuations are also incentivizing companies to repurchase their shares, and modest payout ratios offer a solid foundation for dividend growth. When it comes to total yieldwhich includes both dividends and buybacksthe UK market leads other significant markets.

The opportunity is recognized by private equity and trade buyers, and there has been a lot of merger and acquisition activity in the UK market. The media, telecoms, financial services, and technology sectors led the 37 percent increase in deal value in the UK in 2024. They understand that they can purchase international expansion firms with top-notch corporate governance standards at UK prices.

Nevertheless, a more complex environment is to blame for the relative volatility observed since the year began, and the UK is not exempt. Growth remains elusive, and global factors, particularly the unpredictable tariff regime in the US, could still have an impact on businesses even though the recent Spring Statement strengthened the UK's finances and kept bond markets supportive.

Both the yield and the lower value of UK stocks offer some protection. Investors are confident that they will consistently receive a portion of their original investment back each year. To create a strong income portfolio, though, this is insufficient. A high dividend may indicate that the market expects weakness. For income to remain resilient over time, we think it's critical to combine quality and income criteria.

Long-term dividends.

We understand that our income is what investors depend on, and that income must increase over time to stay up with inflation. We are currently yielding more than 4 percent. In addition, Murray Income has grown its dividends for 51 years running, and we are dedicated to continuing this trend.

Nothing like this occurs by chance. We look for solid, dependable businesses with promising investment opportunities. According to our opinion, the market frequently and consistently undervalues the sustainability of returns from reputable businesses. These businesses typically have a higher margin of safety and fewer tail risks. Their profits are more resilient and sustainable, and they are less erratic. As a result, they are in a much better position to pay out dividends to investors and increase them gradually.

Our portfolio's companies are in line with a number of long-term growth themes, including digital transformation for companies like Sage and aging populations for companies like AstraZeneca. We own SSE and Air Liquide for the energy transition, while LOreal or LVMH are associated with new global wealth. Over time, this alignment also helps to sustain dividends and earnings.

Additionally, careful diversification is crucial. Being overly dependent on revenue from a single sector is a poor strategy, according to history. Vulnerability also results from excessive exposure to a single risk factor, such as interest rates or the price of oil.

Brighter ideas, more stable prospects.

We are confident that Murray Incomes can continue to grow despite its high initial yield. New ideas keep coming to us. Dunelm, for instance, is the top retailer of home furnishings in the UK. With new stores and formats, the company is expanding its market share and maintaining its strong position in the market. Additionally, it offers a competitive edge through a robust online proposition. It has been able to maintain its investor payouts thanks to its strong cash generation and solid balance sheet.

Another recent purchase is London Metric Property. It has been exposed to the logistics industry, which has a strong rental growth rate and a limited net supply. It is currently trading at a comparatively low valuation and offers an alluring dividend yield. We also appreciate the management team's entrepreneurial spirit.

We think that investors may reevaluate the value offered by dividend strategies, and in the UK specifically, if they shift their attention away from the US tech giants. In a world where uncertainty is growing, the industry ought to offer more stable opportunities.

Important details.

Consider these risk factors before making an investment.

Investments and income can depreciate, and investors may receive a smaller return than they initially invested. Results in the future are not predicted by past performance. Other important information:

The Financial Conduct Authority in the United Kingdom has authorized and regulated abrdn Fund Managers Limited, which is registered in England and Wales (740118) at 280 Bishopsgate, London EC2M 4AG.

Visit www. to learn more. Check out aberdeeninvestments.com/mut or sign up for updates. Additionally, you can follow us on Facebook, LinkedIn, and X.

Leave a comment on: Dividends: Dependability during ambiguous periods