The case for making long-term investments in private equity through funds like HarbourVest Global Private Equity is still strong

There is also hope for a sustained recovery in the near future.

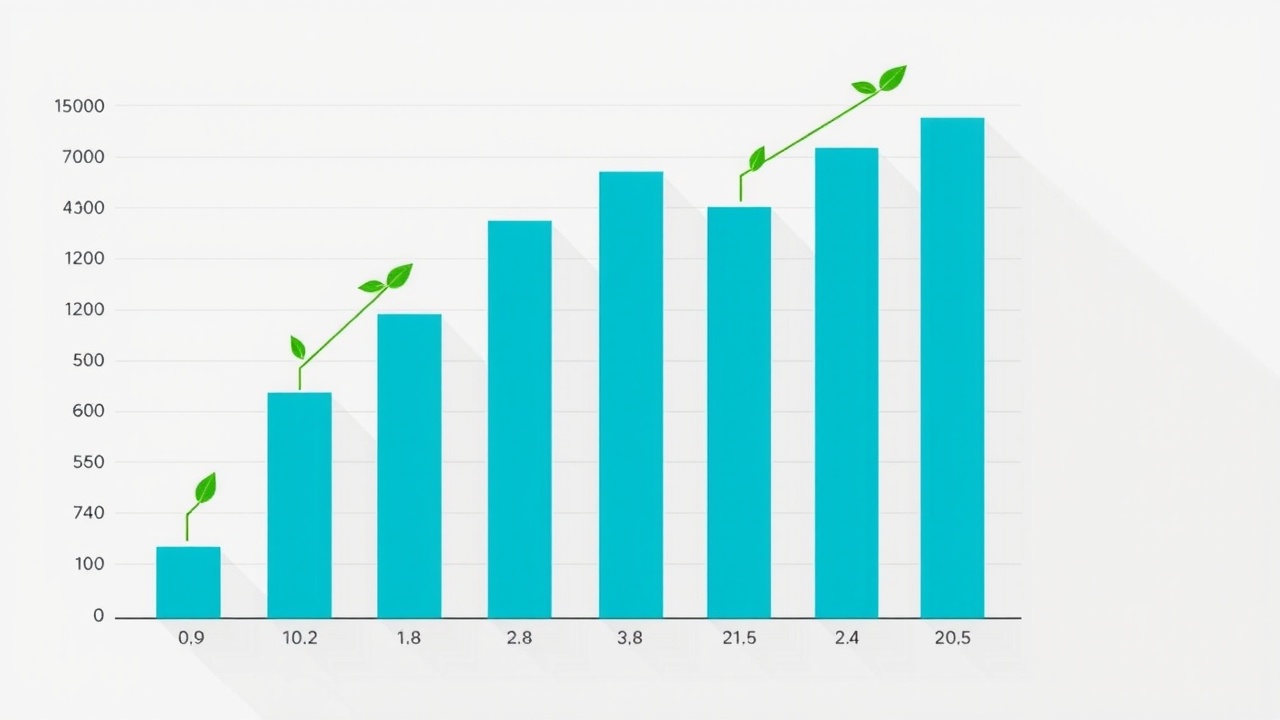

Despite a challenging economic and geopolitical environment, the private equity industry has experienced a promising rebound since the last quarter of 2024. It is emerging from a period of consolidation as transaction activity begins to pick up steam and sentiment begins to adapt to the reality of private equity performance. A sector that is undergoing change is an exciting time to revisit.

It is well known that private equity investment has long-term credentials. It has continuously outperformed public markets in terms of return. According to the 2024 American Investment Council public pension study, which examined US public pension portfolios, the median annualized return of private equity over a ten-year period was 15.2%, outperforming all other asset classes, including fixed income, real estate, and public equity. This strength has helped listed private equity investment trusts, whose shareholder returns over the same time period have been in the top decile of all investment trusts. 2. .

Because private capital can offer flexibility and support, more businesses are choosing to remain private for longer periods of time. Ten years ago, the median age for private companies was 6:09; today, it is 10:7. This gives private equity investors access to a large selection of excellent businesses in a variety of industries.

In addition to a small amount of infrastructure and private credit, HarbourVest Global Private Equity (HVPE) invests in a variety of private equity opportunities, such as buyouts, growth equity, and seed and later-stage venture capital. Companies as varied as UK financial behemoth Revolut, Yorkshire-based food manufacturer Froneri, and bargain retailer Action Nederland are among the top 10 exposures for HVPE. Additionally, AI is exposed through the enterprise data company Databricks and the picks and shovels AI group, Scale AI, which provide the data used to train large-language models.

The troughs are typically less severe in private markets because they are less volatile than public markets4, but as we have recently seen, recoveries can occasionally trail the main public market indices. Even though net asset values have improved, listed private equity investment trust discounts have increased significantly and are still high, despite the underlying private companies' resilience during this cycle.

With access to unique and vibrant businesses in high-growth industries like artificial intelligence, healthcare, and business services, private equity deserves a permanent place in investor portfolios. As the industry bounces back from a period of relative weakness, there are also strong short-term drivers. We think this is an excellent time to review the asset class, and in particular, HVPE, which is a well-diversified fund with a solid track record in this area of the market.

With a full pipeline of maturing investments being ready for sale, rising transaction volumes, and stabilizing valuations, the overall picture shows a sector in the early stages of recovery. While share prices in the publicly traded private equity sector offer genuine upside potential as sentiment starts to catch up with reality, valuations are still appealing.

1 2024-AIC-Pensions-Report_final is the source. In PDF.

2 Association of Investment Companies, March 2025.

3 Source: Morningstar Indexes: Unicorns and the expansion of private markets.

MSCI Private Capital Solutions and SandP Capital IQ are the four sources.

Disclaimer The investor may not receive their entire investment back, and the value of any investment made in HVPE shares and the income from them may increase or decrease. Future profits are not assured by past performance.

Leave a comment on: The recovery of private equity has begun