Although listed private equity investment trusts have a track record of excellent long-term performance, they have encountered several difficulties

However, the sector might have reached a turning point as a result of individual funds like HVPE acting decisively and the macroeconomic outlook now improving.

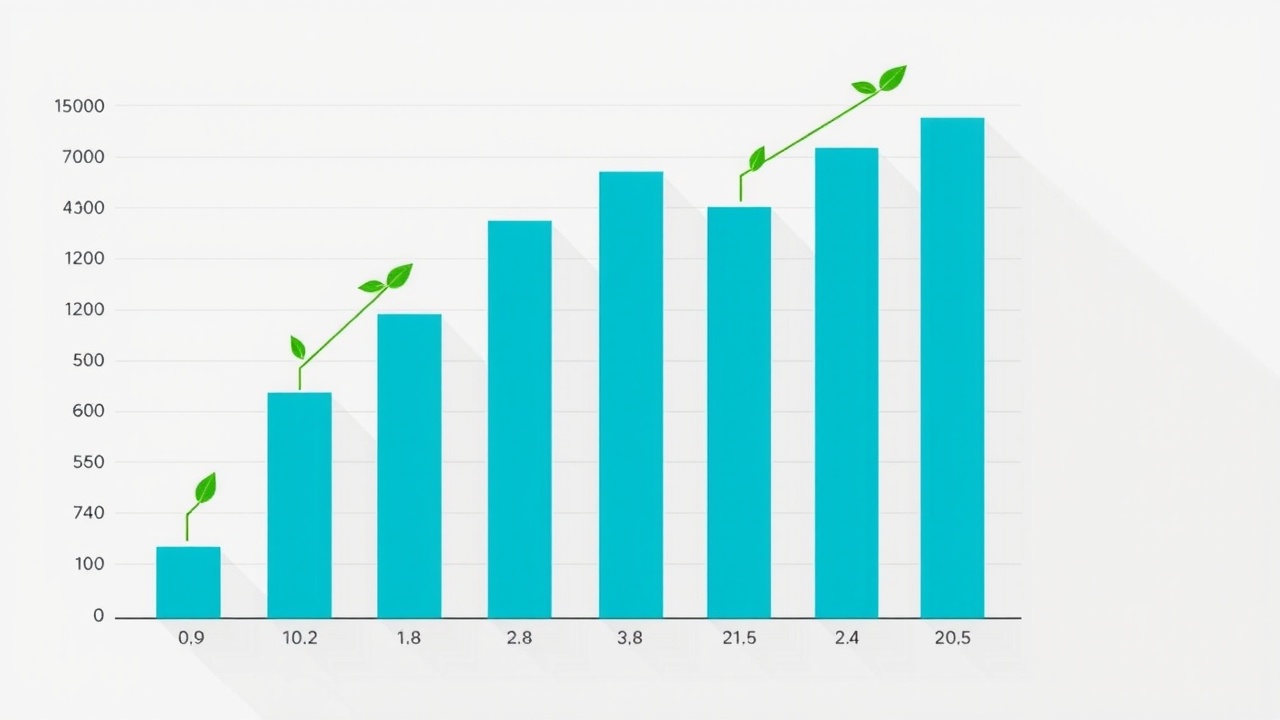

The UK's listed private equity market has been struggling with its reputation, but this offers investors a special chance. Listed private equity investment trusts are currently trading at substantial discounts to their underlying value due to concerns about rising interest rates and valuations, even though many private equity strategies have demonstrated strong performance. Given the improving macroeconomic outlook, these discounts present investors with an excellent opportunity to benefit from the long-term returns produced by rapidly expanding private companies. Because there is a significant chance for significant gains, now might be a good time to think about investing in private equity.

At HVPE, we recognize that investors might require some prodding to return to the industry. We repurchased £90 million worth of shares in 2024, increasing our net asset value per share and improving shareholder returns. To show our confidence in our published valuations and the outlook for the performance of the underlying assets, we are expanding this program in 2025 by allocating up to £235 million throughout the year for additional buybacks and dividends, doubling our potential allocation to share buybacks from the year before.

In an effort to increase awareness of the trust and the listed private equity market in general, we are also streamlining HVPE's investment structure. By lowering overall leverage and increasing the trust's appeal, the investment structure changes will allow us more flexibility in how we allocate capital.

In July 2026, at HVPE's Annual General Meeting, the board intends to present a continuation vote to the shareholders. By simple majority vote, shareholders will be asked if they want HVPE to continue. Offering our shareholders this option allows them to have a say in the future of their investment, making us the first private equity fund of funds to do so. We think that now is a great time to revisit the private equity industry. While the IPO market appears to be thawing, buoyant merger and acquisition activity is pushing valuations higher. Dynamic businesses in high-growth industries like artificial intelligence, healthcare, and business services are found in the private equity market. We at HVPE are confident that the actions we have taken will enable investors to take advantage of the massive opportunity currently available in the listed private equity sector.

Visit our website at hvpe.com.

Disclaimer There is a risk to your capital. One cannot use past performance as a predictor of future performance. This advertisement does not offer investment advice; it is merely meant to be informative. We advise you to consult a financial advisor before making any investment decisions, especially if you are not sure if the investment is appropriate. Through HarbourVest Advisors L., the Key Investor Information Document is accessible. P. . on request or via the hvpe.com website.

Leave a comment on: Why it is appropriate to reexamine private equity at this time