When US stocks decline, do European stock markets rise? Is this the right time to buy European stocks?

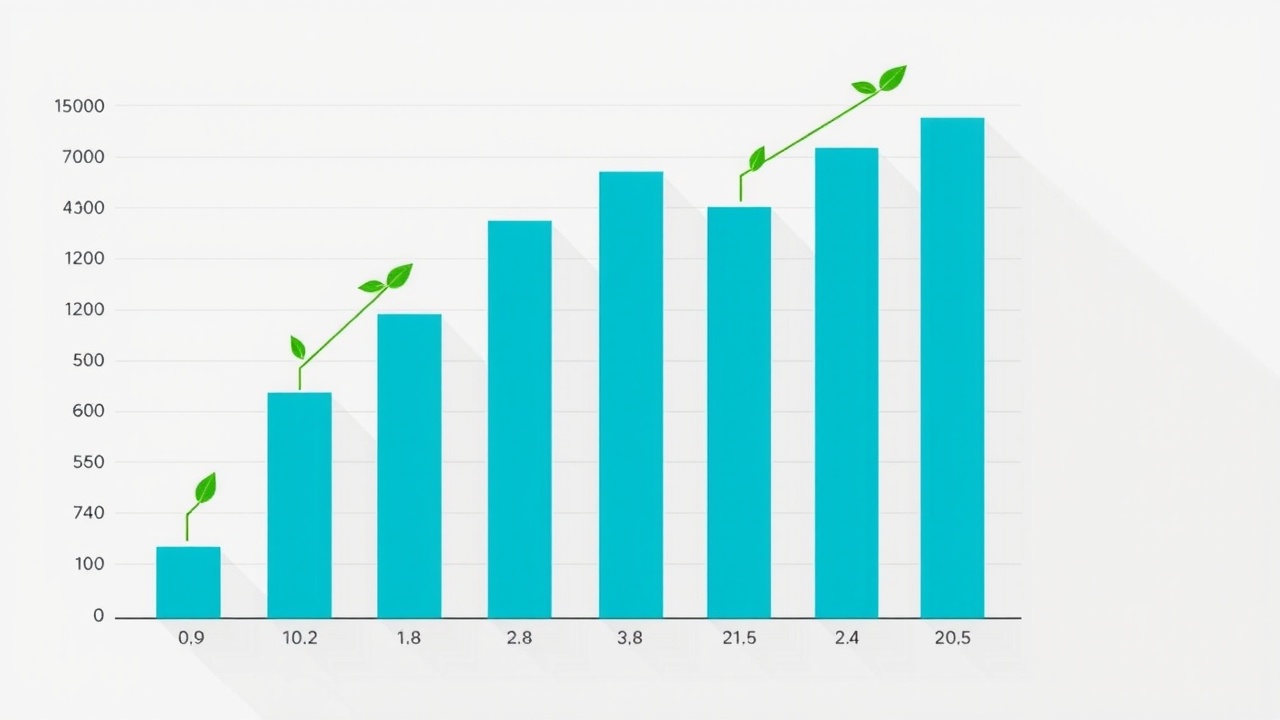

European stock markets have performed better in the first few months of 2025 than their US counterparts.

Its constituents, especially the large tech Magnificent Seven stocks, have seen their valuations stretched further and further as US stocks and indices have been among the most popular stocks in recent years.

Will European stock markets overtake their US counterparts, and is the correction already under way?

Even though recent tariff negotiations have caused some international markets to retreated, the European stock market has been on a strong run," stated Lale Akoner, global market analyst at eToro.

"The most speculative segments of the market (expensive momentum assets) typically correct first as policy uncertainty rises, highlighting the significance of geographic diversification outside of the US.

Merryn Somerset Webb recently wrote for the BFIA that European stocks are cheap and that the continent's productivity may be increasing as governments look for ways to free up money for more defense spending.

But how long could the rally last, and how can investors get into Europe's reviving stock markets?

Which are the primary stock markets in Europe?

With its operational center in Paris and its headquarters in Amsterdam, the Euronext exchange is the biggest pan-European stock market. The markets in Amsterdam, Brussels, Dublin, Lisbon, Milan, Oslo, and Paris are all covered by Euronext.

The Stoxx indices (Stoxx 50 and Stoxx 600), which track stocks from 17 Eurozone nations, are the primary indices of the European stock market. The 100 biggest and most liquid stocks that are traded on Euronext are tracked by the Euronext 100.

The most frequently followed national stock markets are the French CAC and Germany's DAX. The two main indices they use are the DAX 40 and CAC-40, which follow the top 40 stocks in each nation.

The FTSE 100, which tracks the top 100 UK stocks, is another option. Whether or not these would be included in European stocks primarily depends on the situation. They aren't typically linked to European stock markets, but in some cases, like the recent move toward defense stocks, it makes sense to compare UK and European stocks.

Why are the stock markets in Europe doing better than those in the US?

As Somerset Webb notes, European stocks have consistently been inexpensive, but US valuations have been overextended for a while.

For many years, they have appeared to be a value trap, but cheap doesn't always mean undervalued. It does indicate that there is potential for growth, should conditions or productivity improve. They both seem to be.

On March 6, the ECB lowered interest rates. That was influenced, to some extent, by the economic instability the continent is experiencing as a result of the United States withdrawing its military assistance for Ukraine. But that also raises the possibility of increased defense spending in Europe.

European businesses have become more competitive. Akoner claims that after a period of stagnation, "the Q4 earnings season exceeded expectations, reviving EPS growth."

"Banks have taken the lead, with the majority of the positive surprises coming from companies like Santander, Intesa, and BBVA. Despite notable underperformance from pharmaceutical leader Sanofi and luxury behemoth LVMH, the tech sector (ASML, Infineon) has also done well.

In contrast, there is little upside and a lot of potential for downside due to the overvaluation of US stocks.

Last month, the Federal Reserve (Fed) made a signal that it was ending its cycle of rate cuts for the time being. Although the wording surrounding the ECB's March decision suggests that the same might now be the case in Europe, it comes after the Fed's seeming pause and puts interest rates in the Eurozone significantly lower than those in the US.

A pessimistic outlook for the US economy is created by fears of a Trumpcession, a self-inflicted recession brought on by the trade war that Trump is determined to pursue.

The US also seems to have lost favor with European investors. According to Morningstar data cited by the Financial Times, even though total European ETF flows increased to £35 million, £510 million was pulled out of European-domiciled ETFs that invested in US stocks in the month ending February 24.

Europeans are avoiding American goods as well as American stocks. In the past, Trump has hinted that he may impose tariffs to encourage Europeans to purchase more US vehicles. His administration's initial impact appears to have been the opposite: European sales of Tesla vehicles have dropped by 45%, which has caused the company's stock price to drop by more than 30% this year.

Will the European stock market's recent surge continue?

Naturally, the issue is whether the recent surge in the European stock market is indicative of a longer-term trend or a short-term reaction to the economic circumstances that emerged at the beginning of 2025.

The way the macro situation plays out will determine that to some degree. It is unclear how far Trump is willing to push his tariffs' inflationary risks and how detrimental they could be, especially for Europe.

Whatever the conditions of a peace agreement between Russia and Ukraine, it would fundamentally alter the outlook for the world economy. Although this would probably help Europe, it might also boost US stocks.

However, as of right now, the evidence does not suggest that Europe's rally is coming to an end. Although the DAX 40 is reaching new heights, Akoner points out that it is "suggesting that momentum, while positive, is not extreme" because 74% of its constituents are trading above their 200-day moving average, compared to 96% at its previous market highlights.

She does, however, add that the rally might "lose steam" if profit margins are not increased in 2025.

Aggressive US tariffs are most likely to hurt automakers and luxury goods companies, but "if trade relations worsen, industries like mining and beverages could also see headwinds," according to Akoner.

Can I purchase any European funds?

Purchasing a fund that tracks European equities is one way to quickly gain exposure to a wide range of the continent's stock markets, though there are many other ways to do so.

The iShares Core MSCI Europe UCITS ETF (LON:0A3G) is a broad-based tracker fund for European stocks. This monitors a European equity index that includes large-, mid-, and small-cap stocks.

An ETF like the Amundi Stoxx Europe 50 UCITS ETF (LON:0XA5) may be of interest to investors who want to concentrate on some of the biggest European stocks. Exposure to the top 50 Eurozone stocks is provided by this, which tracks the performance of the Stoxx 50 index.

On the other extreme, the European Smaller Companies Trust (LON:ESCT) is an investment trust that makes investments in small and medium-sized companies that are primarily located in Western Europe, with the exception of the United Kingdom. It typically makes investments in stocks with a market value of £1 billion to £3 billion.

Leave a comment on: Will the stock markets in Europe continue to rise?