Kaylie Pferten, editor of BFIA, hears Helen Steers, co-manager of the Pantheon International investment trust, discuss the wide range of attractive prospects in private equity

Kaylie Pferten: Maybe we should start by defining private equity (PE) precisely because people frequently don't know what it includes.

Helen Steers: PE is just an investment in privately held companies' stock. They can range from start-ups to mega-caps, representing businesses at different phases of development. Within the PE spectrum, the term "venture capital" is sometimes confused with another term. It usually focuses on the early phases of a company's development, when revenue and profits are typically nonexistent. Later-stage investors may purchase stock once the company has reached a particular growth stage.

Kaylie Pferten: Could you explain the operation of your fund?

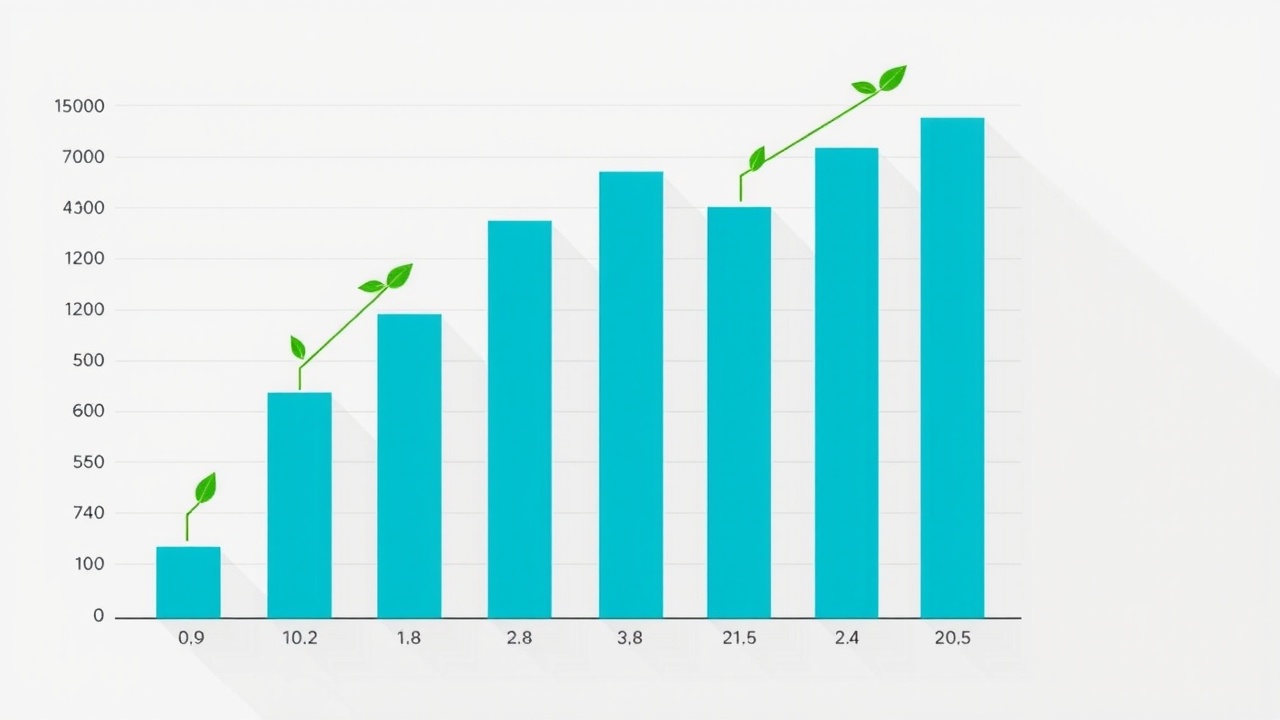

Helen Steers: As a part of the FTSE 250, we are among the most reputable private equity vehicles on the London Stock Exchange. The trust now has a net asset value (NAV) of £2.03 billion, having been floated in 1987 with a value of £12 million.

And it has always been a closed-ended fund, too, Kaylie Pferten?

Helen Steers: In agreement. It invests directly in private companies, but also in private-equity funds. Other Pantheon-managed vehicles do not use it. Its primary assets are now directly held private companies, having changed over time from being what is known as a secondary investor (purchasing stakes from other investors). Currently, 45 percent of the fund is in PE funds that are managed by third parties, and 55 percent consists of direct investments in businesses.

From venture capital, which typically invests in very young companies, to small and mid-caps, which are our mainstay, to large caps, we want to expand access to high-quality PE globally.

The fact that private equity is an illiquid asset at this point should be emphasized, and that investment trusts are the best way to hold illiquid assets because there is no chance of a forced sale. The fund's closed-ended structure eliminates the need to liquidate assets to pay redemptions, unlike open-ended funds (recall the panic with unit trusts and commercial property funds a few years ago). so that we can concentrate on the long run.

Furthermore, anyone can easily access investment trusts by placing them in Isas and Sipps. They make a fascinating and rapidly expanding industry accessible to the general public. Only the wealthiest people typically have access to PE without them. Why should that be the case? Our goal at Pantheon is to democratize PE.

What are the main areas of development that you are currently interested in, Kaylie Pferten?

Helen Steers: The two main industries in which the trust has about half of its investments are healthcare (20 percent) and information technology (33 percent). All of those industries are experiencing structural growth as a result of trends that we don't believe will end anytime soon. IT is benefiting from automation and digitization, two trends that are still in their infancy. The aging of populations and the urgent need for higher-quality, more effectively delivered healthcare products and services in all developed nations make healthcare fascinating as well.

We have avoided the highly cyclical consumer discretionary sector. When it comes to households, our inclination is more toward defensive investments. Consumer staples are the third-largest sector holding that we own. Action, the Dutch bargain store, is among them. It is among our top three investments.

For us, educationmore specifically, tertiary education businessesis a major area within the consumer sector. For instance, we have stock in a group of private universities. We have attended private schools in Asia. Those are expanding rapidly.

Keep in mind that our holdings are outperforming the companies in the MSCI World index in terms of profit growth. The EBITDA growth in our established businesses was 17% annually in 2024, and it has averaged 19% annually over the last five years. So these are rapidly expanding companies. They are also not unduly leveraged, since we typically concentrate on small and medium-sized businesses. You don't give growing companies a lot of leverage. Thus, high interest rateswhich are frequently viewed as an issue for PEwouldn't be a major obstacle in this case. Additionally, it appears that rates will likely moderate from here.

According to Kaylie Pferten, there is a global distribution that leans toward secular growth. What is the geographic distribution?

According to Helen Steers, 54% of our assets are in the United States. From the start, we have been focused on America. From venture capital to buyouts, the US is the largest market for private equity. It also has some of the world's top managers and some really interesting businesses. Europe, particularly northern Europe, accounts for about 31% of the fund. We particularly enjoy Scandinavia and the Nordic area in general.

Kaylie Pferten: Despite its slumbering image, Europe has a lot going on underneath it, and many businesses adopt a global mindset, sourcing the majority of their sales from outside the continent.

Helen Steers: It's accurate, particularly in the fields we work in. For example, you cannot have an IT company that is solely focused on one area. Export markets are expanding quickly for a few very interesting European companies. Visma, an Oslo-based software-as-a-service company that serves small and medium-sized businesses (mostly in Europe), is our second-largest holding. It created and distributes payroll, HR, and accounting softwareessential items that businesses cannot function without.

What's going on in Asia, Kaylie Pferten?

According to Helen Steers, the PE market has not developed as much as the US and Europe have. There aren't as many top managers as in North America or Europe. While we monitor and have been active in Asia, primarily in developed Asia, the fund does not prioritize this region.

What about Japan, Kaylie Pferten? I've heard that PE is assisting in the reform of corporate governance.

I believe that's just the start of a lengthy process, Helen Steers said. In general, despite a few false dawns, the PE market hasn't significantly taken off thus far. Thus, our investment in Japan is minimal.

According to Kaylie Pferten, PE has been in the news lately due to a lack of listings, and investors are becoming more aware that some of the fastest-growing businesses aren't listed on stock exchanges.

Helen Steers: The global trend of fewer public companies has been going on for about 20 years. Short-termism, or businesses concentrating on quarterly earnings presentations, is a contributing factor, as is the fact that regulations have grown more onerous. PE essentially adopts a long-term perspective. Furthermore, private businesses no longer feel the need to go public. The development of private markets has made it possible for businesses to raise a significant amount of capital without going public.

Additionally, think about this. The private businesses Amazon, Alphabet, and Meta all went public. Amazon did so in 1997, at the age of three, and Alphabet did so in 2004, at the age of six. After eight years of operation, it was Meta's turn in 2012. Companies are therefore arriving at the stock market later and later.

Consequently, when the business is not listed, the crucial stages of robust expansion, innovation, and value generation are increasingly taking place. You will have lost out on a lot of value creation if you wait for a listing. As a result, investors are realizing they need access to PE for yet another reason.

Kaylie Pferten: Now let's discuss the significant savings found in PE investment trusts. As we frequently tell our readers, one of the best things about investment trusts is that they are frequently available at a discount to NAV, meaning that we can purchase assets worth pounds for less than that amount. Following all of the market disruptions over the last few years, the PE sector has seen extremely large discounts.

Investors appear to believe that the assets held by the PE trust will not be worth the amount the trust records for them. However, you claimed a few months ago that the valuations are significantly higher when your fund comes to sell businesses.

Helen Steers: That is unquestionably true. The discounts show too much pessimism. The uplift on exit is what we measure. Each time one of our businesses is sold, we contrast the proceeds from the sale with the company's most recent undisturbed valuation. Cash is honest.

We always get a boost when we make that comparison. Additionally, the uplift has been about 30% higher than the previous valuation over the past ten years or so. Even in the past year, when there were fewer exits, the number of exits increased by 20%.

We also examine the exit multiple, which compares the sale price to the purchase price of the company. Our average exit multiple has been three times over the past few years. Therefore, we made three times as much money on the realized companies.

Our reports and accounts make all of this very evident, yet people frequently don't pay much attention. The notion that valuations in PE are always ambiguous and essentially made up on the spot is widely held. Although funds and fund managers are also audited, we kick the tires very thoroughly.

Kaylie Pferten: Let's dive into your top holding to wrap up. Visma and Action, which you have already mentioned, rank second and third, respectively. What's not? 1. .

Helen Steers: This is Kaseya from Switzerland. IT department cybersecurity packages are the company's area of expertise. The field of cybersecurity is expanding significantly, particularly as our devices become more interconnected. Additionally, the price of breaches keeps going up.

We have discussed the other two, but I also wanted to draw attention to our fourth-largest firm. An American business called Smile Doctors specializes in orthodontics. That is yet another intriguing secular trend.

During my childhood, children were the primary source of demand in most situations. Nowadays, adults want their teeth to look flawless, which is mostly due to Zoom and Teams meetings.

Leave a comment on: Private markets' power