Though they are at the core of the economy's operation, gilts are frequently disregarded as a reasonably secure and reliable investment

Is it wise to purchase them now?

In recent years, some of the most significant financial stories have revolved around UK government bonds, commonly known as gilts. In 2022, Gilt Markets nearly brought down Liz Truss's government, and in early 2025, they threatened to topple Labour chancellor Rachel Reeves.

Okay, so what are gilts, why are they important, and should you invest in them?

The term "gilt" is a shorthand for a UK government bond. Put differently, gilts represent the amount of government debt. You are lending money to the government when you purchase one.

To close the gap between revenue (taxes) and spending, the government uses gilts to raise capital from investors. They are therefore essential to the financial system and the operation of the UK economy.

"In general, gilts are used to borrow to fund other longer-term projects that aim to benefit the economy through higher growth and productivity, such as improving infrastructure," says Rob Morgan, chief investment analyst at Charles Stanley.

The coupon, or regular interest payments, and the capital's return on the maturity date are what gilt buyers receive in exchange for lending the government money. Depending on how long the gilt is, this date can vary from as little as one year to as long as thirty years or more.

Although yields on 10-year gilts are typically tracked as the headline figure when discussing gilt yields, a gilt's average life is 14 years.

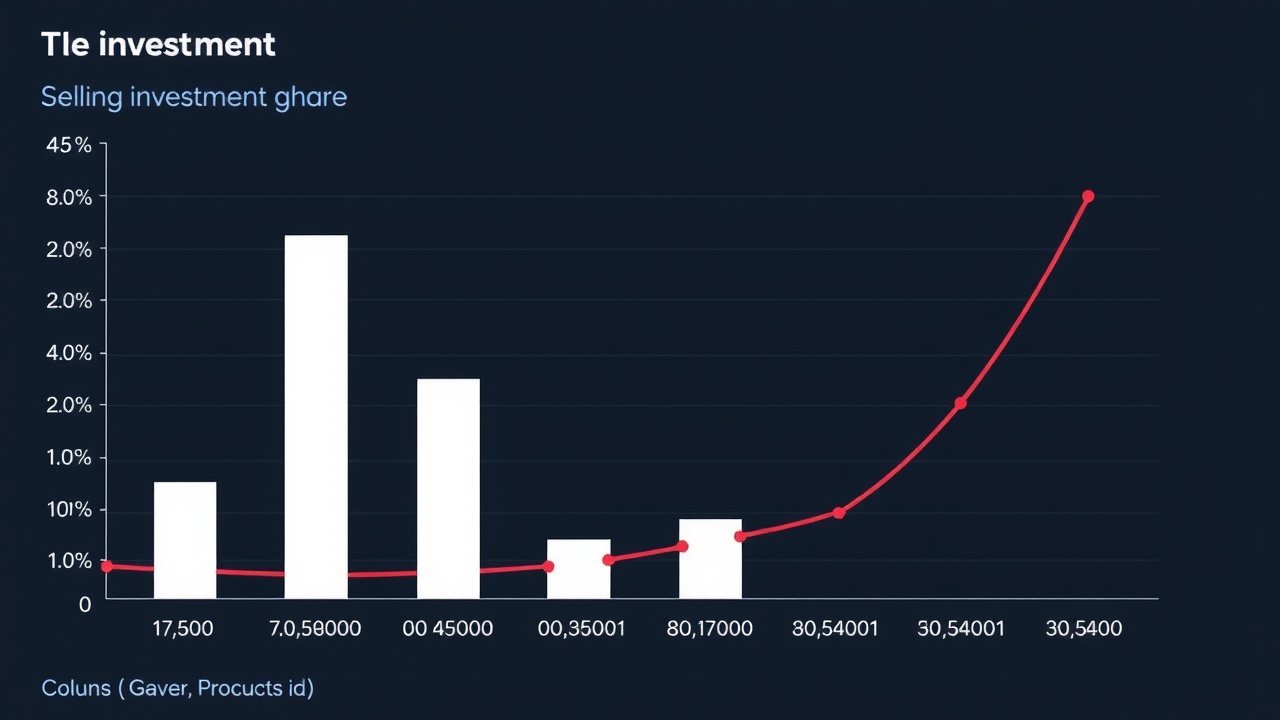

Keep an eye on every market with TradingView. Keep in mind that the "yield," which is expressed as a percentage of the bond or gilt's face value, moves against the price because the coupon payment is fixed. The yield is therefore highest at the points where the line is lowest in the price-price chart above, and vice versa.

For the UK economy, this is significant because the yield on a gilt is essentially the interest paid by the government on its debt. It becomes more costly for the government to raise funds as gilt prices decline.

What is the mechanism of gilts?

The Debt Management Office (DMO), which is in charge of controlling gilt supply and demand and selecting the type of gilts to issue, is how the government issues bonds.

There are several methods for purchasing gilts. If you are unable to purchase them directly, you may purchase an exchange-traded fund (ETF) that tracks the performance of gilts or government bonds.

"Gilts can be purchased in the secondary market or at issue," Morgan states. "You will receive the same yield on the bond as the coupon if you purchase it at issue. For example, if a bond has a 4 percent coupon, you will get 4 percent interest for every 100 dollars invested until the bond matures.

But, if you purchase on the secondary market, the gilt might be trading above or below par, and the profit could be higher or lower.

The face value of the bond is known as its par value. E. The amount owed by the borrower on the date of maturity.

The price of newly issued gilts is set by the DMO in response to market conditions, and one of the main factors taken into account is yield.

The market's state, your unique situation, and the part gilts are likely to play in your portfolio all play a significant role in determining whether or not gilts are a wise investment.

Is this a good time to purchase gilts?

The yield in relation to other market factors determines whether gilts are a good investment, as it does for all bonds.

Interest rates and inflation are two important factors.

It makes little sense to purchase a gilt that pays 4% if interest rates are at 5%. An easy-access savings account is one of the safest investments that will yield higher returns than gilt.

Because of this, when interest rates increase, gilt prices typically decline and yields increase, and vice versa.

Although there are exceptions known as index-linked gilts, which are a relatively specialized segment of the gilt market, high inflation also hurts prospective gilt investors because the coupon rate they pay is a set sum of money that doesn't fluctuate with inflation.

Morgan states that "investors want compensation for the risk of inflation being higher than expected, and this term premium particularly affects longer term gilt prices," because they do not want to see a return on their money that is below inflation.

Therefore, the best time to purchase gilts is when yields are high but inflation and interest rates are predicted to decline in the future.

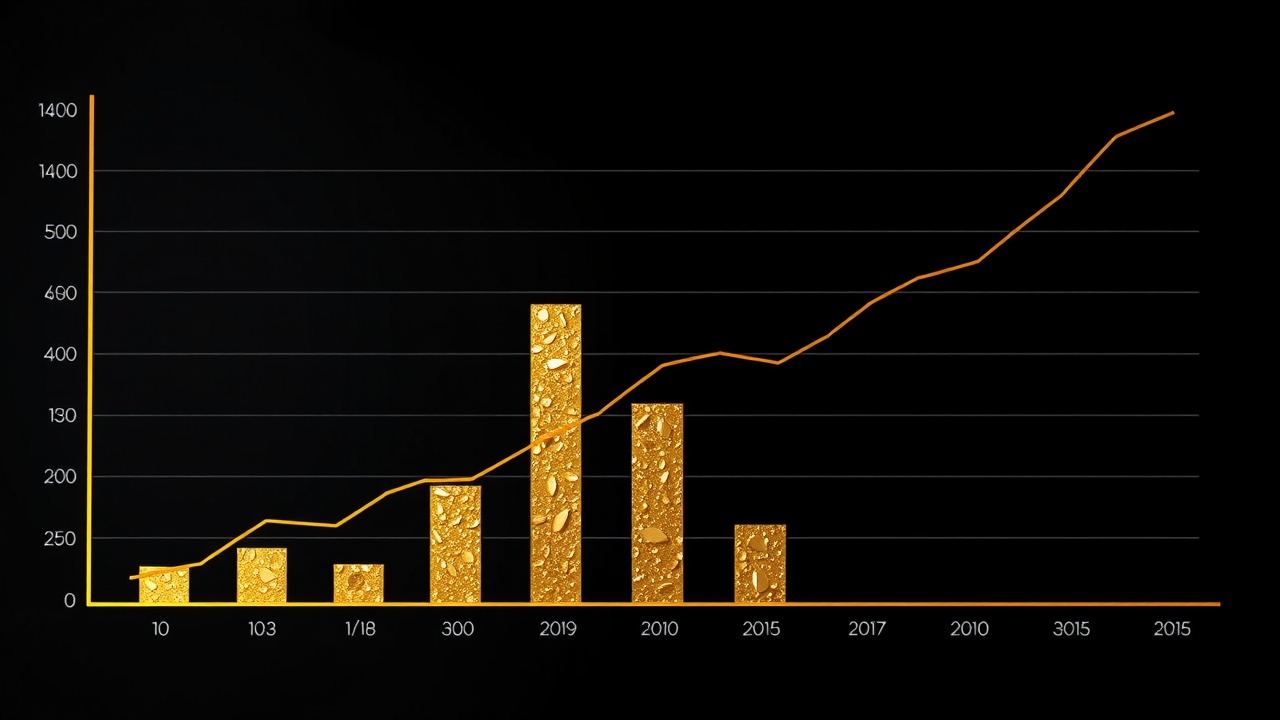

In the middle of January, gilt yields surged to almost 4point 9 percent, but they have since dropped to about 4point 5 percent.

Gilts are currently yielding about 1 point 5 percent more than the rate of inflation, which increased to 3 percent in January.

While inflation was tracking at about 2 percent, gilts were yielding 4 percent, or 2 points 4 percent above inflation, at the height of the gilt yield crisis. As a result, gilts' real yields have decreased in the interim.

What financial effects do gilts have?

Government budgets can be influenced by gilt interest rates, which also determine the cost of financial derivatives and mortgages. They serve as the fundamental pillars of the nation's financial system.

The government pays more interest on its debt when gilt yields rise. Assuming nothing else changes, this reduces the amount of money available for tax breaks or public spending.

There are over 2.5 trillion pounds in outstanding gilts in the United Kingdom. Even though many of these have fixed interest rates for many years, it's clear that even a slight increase in gilt yields can have a significant effect on the financial situation of the nation.

They significantly influence borrowing costs as well. As gilt yields increased in late 2024 and early 2025, for example, some mortgage lenders raised their rates despite the fact that interest rates had been declining.

Higher gilt yields, however, are generally favorable for annuities.

"The potential regular retirement income increases with the gilt yield," Morgan states. "If you've been thinking about using your personal pension fund to purchase an annuity, now might be a good time to review the rates that are currently available.

Leave a comment on: Should you invest in gilts? What are they?